In the United Arab Emirates (UAE), Anti-Money Laundering (AML) compliance is not just a regulatory requirement but a cornerstone for establishing a transparent and secure financial ecosystem. As the UAE intensifies its efforts to align with global financial standards, AML compliance has become a focal point for both governmental oversight and corporate responsibility. The nation’s commitment to combating money laundering and financial terrorism is evident in its stringent AML and Counter Financing of Terrorism (CFT) laws. These laws are designed to safeguard the integrity of financial institutions and Designated Non-Financial Businesses and Professions (DNFBPs), thereby fortifying the UAE’s position as a trusted global financial hub.

Non-compliance with AML regulations can lead to severe repercussions, including hefty fines. Moreover, the reputational damage incurred can be irreparable, affecting not just the financial standing but also the operational viability of the business. In extreme cases, non-compliance can even lead to the revocation of business licenses, effectively ceasing the company’s operations in the UAE.

Mistakes to avoid while building AML compliance serves as a guiding principle for this blog post. It encapsulates the essence of what businesses need to be vigilant about when establishing their AML frameworks.

1. Underestimating the Role of AML Compliance Officers

One of the most critical “Mistakes to avoid while building AML compliance” is underestimating the role of AML Compliance Officers. These professionals serve as the linchpin in any organization’s AML framework. They are responsible for developing, implementing, and overseeing the company’s AML policies, ensuring that the organization remains in compliance with UAE’s stringent AML regulations. Their role extends from conducting risk assessments to employee training and liaising with regulatory bodies, making them indispensable to the organization’s financial integrity.

Failing to provide AML Compliance Officers with adequate resources and authority is another mistake that can have dire consequences. Without the necessary tools and decision-making power, these officers cannot effectively enforce compliance measures or adapt to changing regulatory landscapes. This limitation can lead to compliance failures, exposing the company to legal repercussions, including hefty fines and reputational damage.

For instance, Company A in the UAE faced a fine of AED 600,000 due to lapses in its AML compliance framework. Upon investigation, it was found that the AML Compliance Officer was not given sufficient resources to implement necessary controls, leading to the violation. On the other hand, Company B, which invested adequately in its AML Compliance Officer’s role, successfully mitigated similar risks and even improved its operational efficiency.

| Factors | Company with Strong AML Compliance Officer Role | Company with Weak AML Compliance Officer Role |

| Risk Assessment Accuracy | High | Low |

| Regulatory Fines Incurred | None | Multiple |

| Employee AML Training | Comprehensive | Inadequate |

| Adaptability to Regulatory Changes | Quick | Slow |

| Overall Compliance Rating | Excellent | Poor |

One of the most crucial “Mistakes to avoid while building AML compliance” is neglecting the role of AML Compliance Officers. By understanding the importance of this role and allocating appropriate resources and authority, companies can significantly enhance their AML compliance frameworks, thereby safeguarding themselves from the legal and financial repercussions of non-compliance.

2. Lack of Internal Communication

One of the often-overlooked “Mistakes to avoid while building AML compliance” is the lack of effective internal communication. Open and transparent communication within an organization is not just a best practice but a necessity when it comes to AML compliance. Effective internal communication ensures that all departments, from top management to frontline employees, are aligned in their understanding and execution of AML policies. This alignment is crucial for identifying and mitigating risks, thereby enhancing the overall effectiveness of the AML compliance framework.

Case Studies Highlighting Failures Due to Poor Communication

- Case Study 1: Company X, a financial institution in the UAE, faced a fine of AED 400,000 for non-compliance with AML regulations. The root cause was traced back to poor internal communication, where the compliance team was not informed of new business activities that posed a high risk of money laundering.

- Case Study 2: Company Y, another UAE-based entity, was penalized for failing to report suspicious transactions. The investigation revealed that the lack of communication between the transaction monitoring team and the AML Compliance Officer led to this oversight.

Checklist for Effective Internal Communication in AML Compliance

| Checklist Item | Description |

| Regular AML Compliance Meetings | To discuss updates in AML regulations and assess the organization’s standing |

| Cross-Departmental Communication Channels | To ensure seamless flow of compliance-related information |

| Escalation Protocols | Clearly defined steps for escalating compliance issues |

| Feedback Mechanisms | Systems for employees to report concerns or provide input on AML policies |

| Compliance Updates | Regular bulletins or newsletters to keep staff updated on AML matters |

The lack of internal communication is among the critical “Mistakes to avoid while building AML compliance.” Effective communication is not just a procedural requirement but a strategic imperative that impacts the success of an organization’s AML compliance framework. By fostering a culture of open communication, companies can significantly reduce the risk of compliance failures and the associated legal repercussions.

3. Relying on Poor Quality Data

One of the most significant “Mistakes to avoid while building AML compliance” is relying on poor quality data. Bad data can severely undermine the effectiveness of an organization’s AML compliance framework. Inaccurate, incomplete, or outdated data can lead to incorrect risk assessments, ineffective transaction monitoring, and ultimately, compliance failures. The ripple effect of poor data quality can extend to legal repercussions, including fines and reputational damage.

Types of Bad Data and Their Impact on AML Compliance

| Types of Bad Data | Impact on AML Compliance |

| Inaccurate Data | Leads to incorrect risk assessments |

| Incomplete Data | Hampers effective transaction monitoring |

| Outdated Data | Results in non-compliance with current regulations |

| Unstructured Data | Makes data analysis and reporting difficult |

Relying on poor quality data is a grave mistake in the realm of AML compliance. It’s imperative for organizations to invest in data quality management to avoid this common pitfall. Accurate and reliable data is not just a technical requirement but a compliance necessity. Therefore, one of the key “Mistakes to avoid while building AML compliance” is neglecting data quality, which can have far-reaching consequences on an organization’s compliance framework.

4. Using Outdated Transaction Monitoring Systems

One of the critical “Mistakes to avoid while building AML compliance” is the continued reliance on outdated transaction monitoring systems. Traditional systems often lack the capabilities to adapt to the evolving nature of financial crimes. They may not be equipped to handle high volumes of transactions or detect complex patterns indicative of money laundering. These limitations can result in false positives or, worse, miss genuinely suspicious activities, thereby compromising the effectiveness of an organization’s AML compliance framework.

The financial ramifications of using outdated transaction monitoring systems can be substantial. Not only do these systems require frequent manual interventions, but they also increase the risk of compliance failures. The cost of non-compliance, including potential fines and reputational damage, can far outweigh the initial savings from sticking with an outdated system.

Comparison of Traditional vs Modern Transaction Monitoring Systems

| Features | Traditional Systems | Modern Systems |

| Adaptability to Regulatory Changes | Low | High |

| Volume Handling Capabilities | Limited | Extensive |

| False Positive Rates | High | Low |

| Cost of Ownership | Initially Low, High Long-term | Initially High, Low Long-term |

| Efficiency in Detecting Suspicious Activities | Moderate | Excellent |

5. Not Adapting to the Changing Regulatory Landscape

One of the cardinal “Mistakes to avoid while building AML compliance” is failing to adapt to the ever-changing regulatory landscape. AML regulations are dynamic, reflecting the evolving nature of financial crimes and global compliance standards. Staying updated with these changes is not just a regulatory requirement but a strategic imperative for organizations. Ignorance or non-adherence to new regulations can lead to compliance failures, resulting in legal repercussions and reputational damage.

Timeline of Recent Regulatory Changes in AML Compliance in the UAE

| Year | Regulatory Change | Impact on Organizations |

| 2019 | Introduction of Enhanced Due Diligence Measures | Increased scrutiny of high-risk customers |

| 2020 | Update on Reporting Protocols | Streamlined reporting processes |

| 2021 | New Guidelines on Risk Assessments | More comprehensive risk evaluation |

| 2022 | Stricter Penalties for Non-Compliance | Increased financial and legal repercussions |

Not adapting to the changing regulatory landscape is among the critical “Mistakes to avoid while building AML compliance.” Organizations must proactively monitor regulatory updates and adjust their compliance frameworks accordingly. Failure to do so can result in severe consequences, both legally and reputationally, thereby undermining the organization’s standing in the financial ecosystem.

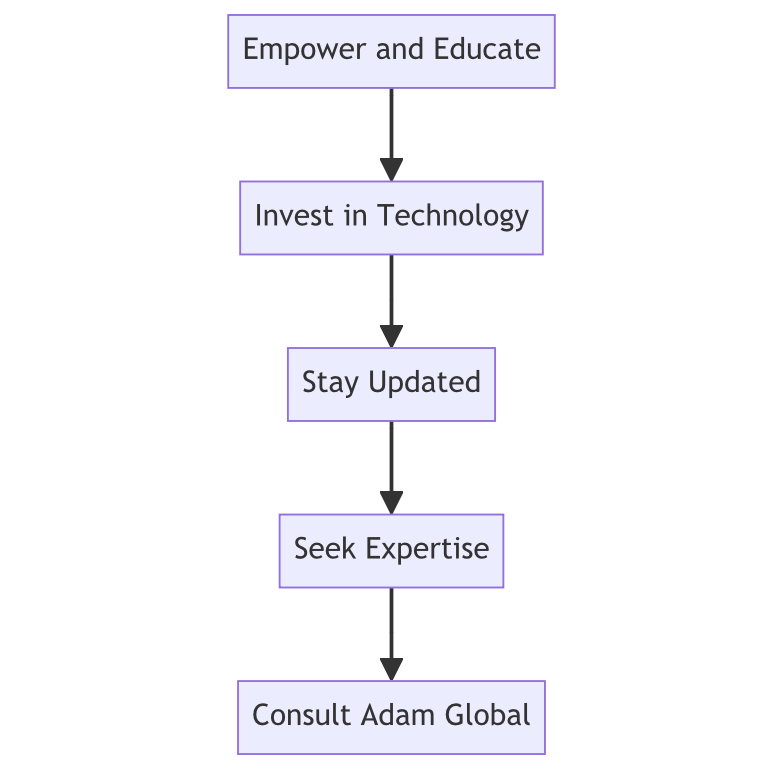

Three Simple Steps to Avoid Mistakes in AML Compliance

1. Empower and Educate

Equip your AML Compliance Officers with the necessary resources and authority. Ensure that they, along with your entire team, are educated on the latest AML regulations and best practices.

2. Invest in Technology

Upgrade to modern transaction monitoring and data management systems that can adapt to the evolving nature of financial crimes and regulations. This will help you stay ahead of compliance issues.

3. Stay Updated and Seek Expertise

Regularly monitor changes in AML regulations and adjust your compliance framework accordingly. For complex compliance requirements, don’t hesitate to seek external expertise. Adam Global, for instance, offers comprehensive AML Compliance Services tailored to meet your organization’s specific needs.

By following these three simple steps, you can significantly reduce the risk of encountering common mistakes in AML compliance. It’s a proactive approach that can save your organization from legal repercussions and reputational damage

Conclusion

Avoiding common mistakes in AML compliance is crucial for any organization, especially in the ever-changing regulatory landscape. By empowering your AML Compliance Officers, investing in modern technology, and staying updated with the latest regulations, you can significantly mitigate risks. For those seeking specialized expertise, Adam Global offers comprehensive AML Compliance Services tailored to your specific needs.

Don’t leave your organization’s compliance to chance. Take proactive steps today to strengthen your AML framework. Contact Adam Global for a consultation and let us help you navigate the complexities of AML compliance effectively.