In the dynamic business landscape of the United Arab Emirates (UAE), compliance with tax regulations is paramount. One of the critical components of this compliance is the Tax Registration Number (TRN). Whether you’re a seasoned entrepreneur or a newcomer to the UAE business scene, understanding the TRN and its significance is essential. In this article, we’ll delve deep into the world of TRN, its importance, and the various methods to find it for a company in the UAE.

What is a Tax Registration Number (TRN) in UAE?

The TRN, also known as the Tax Registration/Identifying Number, is a unique 15-digit number assigned to businesses for identification purposes. This number serves as the official representation of your business to the UAE government. In the accounting realm, organizations and individuals have distinct identities. The Federal Tax Authority (FTA) issues this identification number, which is used on various government documents and to track transactions. The format of the UAE tax identification number is 100-xxxx-xxxx-xxxx.

Why is TRN Important?

The Tax Registration Number (TRN) is not just a mere identifier; it holds significant importance in the business and tax ecosystem of the UAE. Here’s a detailed look into its importance:

- Legitimacy and Compliance: Possessing a TRN is a clear indication that a business is registered with the Federal Tax Authority (FTA) and is compliant with the UAE’s tax regulations. It serves as a testament to the company’s legitimacy and its commitment to adhering to the nation’s laws.

- Tax Identification: The TRN is essential for the FTA to identify and track tax payments made by businesses. It ensures that companies are paying the correct amount of taxes and allows for efficient monitoring and auditing of tax transactions.

- Facilitation of VAT Transactions: With the introduction of Value Added Tax (VAT) in the UAE, the TRN has become crucial for businesses. It is required for various VAT-related processes, such as filing VAT returns, claiming input tax credits, and issuing VAT invoices. Without a TRN, businesses cannot charge VAT to their customers, nor can they reclaim VAT paid on their purchases.

- Business Transactions and Partnerships: When businesses engage in B2B transactions, the TRN serves as a verification tool. Companies often check the TRN of potential partners or suppliers to ensure they are dealing with legitimate entities. It adds a layer of trust and credibility to business relationships.

- Government Documentation: The TRN is used in various government documents, from tax returns and official correspondence with the FTA to import/export documentation. It ensures that all business-related activities are linked to the correct entity, facilitating transparency and accountability.

- Access to Government Services: Many government services, especially those related to business licensing, permits, and tax-related matters, require companies to provide their TRN. It acts as a key to access these services, ensuring that only registered and compliant businesses can avail of them.

- Protection Against Fraud: The TRN system helps in preventing fraudulent activities. Since the TRN is unique to each business, it’s challenging for unauthorized entities to impersonate a legitimate business. It provides an added layer of security against potential fraudsters trying to evade taxes or engage in illegal business practices.

How to Find a TRN Number for a Company in UAE

Finding a TRN number in the UAE is straightforward, thanks to the various methods available:

- Check the Company’s Documents: The TRN is typically present in a company’s official documents, Invoices and tax returns are also reliable sources where the TRN can be found.

- Government Websites: Some countries, like the USA and India, have official websites where one can find equivalent identification numbers. In the Middle East, many official company websites display the TRN, making it easier for stakeholders to access it.

- Contact the Company or its Accountant: If you have a legitimate reason, you can directly reach out to the company or its accountant to inquire about the TRN. However, this information isn’t readily available to everyone, so ensure you have the proper authorization.

Who all are eligible to Register for TRN number in Dubai, UAE

In the UAE, the Tax Registration Number (TRN) is a crucial component for businesses and individuals involved in taxable activities. The Federal Tax Authority (FTA) has set specific criteria to determine eligibility for TRN registration. Here’s a detailed breakdown of who is eligible to register for a TRN in the UAE:

Businesses with a Mandatory Requirement:

VAT Threshold: Businesses with an annual turnover exceeding the mandatory registration threshold (as specified by the FTA, which was AED 375,000 at the time of the last update) are required to register for VAT and obtain a TRN.

Taxable Supplies: This includes the total value of goods and services supplied by the business, which are not exempt from VAT.

Businesses Opting for Voluntary Registration:

Even if a business does not reach the mandatory registration threshold, it can still opt for voluntary registration if its annual turnover or expenses (which will be subject to VAT) exceed the voluntary registration threshold (which was AED 187,500 at the time of the last update).

Non-resident Businesses:

Non-resident businesses that provide goods or services in the UAE and do not have a fixed establishment in the country are also eligible for TRN registration. This is especially relevant if the UAE recipient of the service does not account for VAT under the reverse charge mechanism.

Tax Groups:

Multiple businesses can also register as a single tax group (or VAT group) if they are related/associated parties. This is beneficial for businesses that are closely linked by financial, economic, and regulatory factors. Registering as a tax group allows such entities to file a single VAT return, covering all the entities within the group.

Government Entities:

Certain government entities, as specified by the FTA, may be required to register for a TRN, especially if they are involved in business activities.

Individuals Involved in Taxable Activities:

In specific scenarios, individuals who are involved in activities that are subject to VAT may also be required to register for a TRN.

Special Free Zones:

Businesses operating within designated zones (special free zones) might have different VAT implications. While they might be considered outside the UAE for VAT purposes, certain transactions might still necessitate VAT registration.

It’s essential to note that while some entities are mandated to register for a TRN, others might find it beneficial to register voluntarily, especially if they incur significant VAT on costs, as this allows them to reclaim the VAT paid.

Penalties for a company in Dubai, UAE for not Registering TRN number

In Dubai, UAE, businesses that fail to register for a Tax Registration Number (TRN) can face severe penalties. It is crucial for companies to understand the importance of TRN registration and the consequences of non-compliance. Here are some of the penalties associated with not registering for a TRN:

- Late Registration Penalty: Companies that do not register for a TRN within the specified timeframe set by the Federal Tax Authority (FTA) can be fined. This penalty is a significant financial burden for businesses and can impact their profitability.

- Non-disclosure of Taxable Transactions: Businesses that fail to disclose taxable goods and services during the TRN registration process can face a penalty of up to 50% of the unpaid tax amount. This penalty can be a substantial cost for companies, especially those with high volumes of taxable transactions.

- Failure to Display VAT-Inclusive Prices: Companies that do not display prices inclusive of VAT can be fined AED 15,000. This penalty is particularly relevant for businesses in the retail and service sectors, where displaying VAT-inclusive prices is a legal requirement.

- Inadequate Record-Keeping: Businesses are required to maintain accurate financial records for a minimum of five years. Failure to do so can result in a fine of AED 10,000 for the first violation and AED 50,000 for subsequent violations. Proper record-keeping is essential for tax compliance and financial management.

- Obstruction of FTA Officials: Hindering or obstructing FTA officials from performing their duties can result in a penalty of AED 50,000. Companies should cooperate fully with FTA officials to avoid this penalty.

TRN registration is a critical requirement for businesses in Dubai, UAE. Failure to register can result in substantial penalties that can negatively impact a company’s financial health. Businesses should prioritize TRN registration and ensure compliance with all tax regulations to avoid these penalties.

Difference Between Corporate Tax Number and VAT Tax Number

| Criteria | CT-TRN Number | VAT-TRN Number |

| Specificity | Specific to Corporate Tax | Specific to Value Added Tax (VAT) |

| Usage | Used for Corporate Tax Compliance | Used for VAT Compliance and Reporting |

| Applicability | May not be applicable in all countries | Common in countries with a VAT system |

- CT-TRN Number: This number is specific to Corporate Tax and is used for compliance related to corporate taxation. It might not be a standard in all countries, as not every country might have a separate identifier for corporate tax.

- VAT-TRN Number: This number is specific to the Value Added Tax system. It’s used for VAT compliance, reporting, and other related activities. Countries that have implemented a VAT system typically use this number to identify and track VAT-related transactions of businesses.

How to Register for TRN Number in UAE

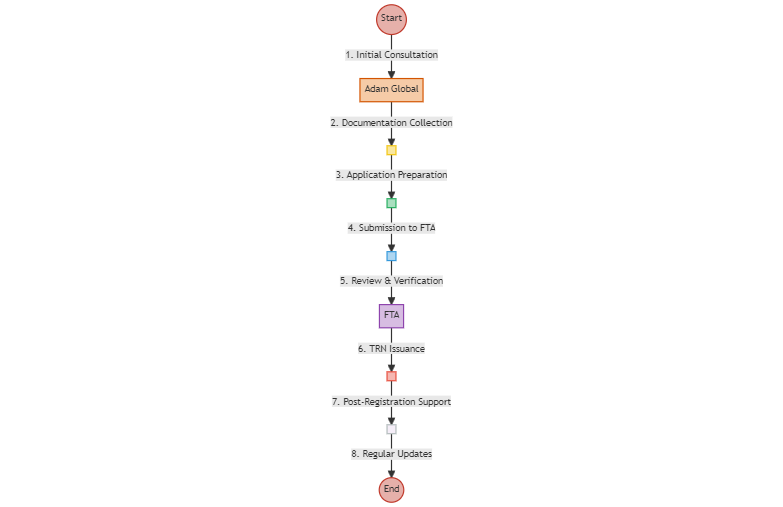

Initial Consultation:

Begin by scheduling a consultation with Adam Global. Their team of experts will provide insights into the VAT registration process, assess your business’s eligibility, and guide you on the necessary documentation.

Documentation Collection:

Adam Global will provide you with a list of required documents. Typically, these include:

- Trade license copy

- Passport copies of the business owner and partners

- Emirates ID copies (if applicable)

- Memorandum of Association (MOA)

- Bank account details and a letter from the bank

- Details of business activities and income sources

- Any other documentation specific to your business type or industry.

Application Preparation:

The team at Adam Global will assist in filling out the VAT registration form, ensuring all details are accurate and complete.

Submission to the Federal Tax Authority (FTA):

Once the application is prepared, Adam Global will submit it on your behalf to the FTA through the e-Services portal.

Review and Verification:

The FTA will review the application and may request additional information or clarifications. Adam Global will handle any queries, ensuring a smooth process.

TRN Issuance:

Upon approval, the FTA will issue a unique TRN for your business. Adam Global will notify you and provide you with the TRN details.

Post-Registration Support:

Adam Global offers post-registration services, such as VAT return filing, VAT consultancy, and audit support. They can assist in ensuring your business remains compliant with VAT regulations.

Regular Updates:

Tax regulations and requirements can evolve. Adam Global will keep you updated on any changes, ensuring your business adapts accordingly.

Conclusion

In the ever-evolving UAE business landscape, staying compliant and informed is crucial. The TRN is more than just a number; it’s a testament to a company’s legitimacy and commitment to adhering to the nation’s tax laws. Whether you’re looking to verify a potential business partner’s credentials or ensure your own company’s compliance, understanding the TRN and how to find it is invaluable.

Adam Global provides expert guidance throughout the TRN registration process in Dubai, ensuring accuracy and compliance. With their in-depth knowledge of UAE’s tax landscape, they simplify complex procedures, offer post-registration support, and keep businesses updated on changing tax regulations, making them a one-stop solution for all corporate needs.

FAQ’s

1. What is a TRN in Dubai, UAE?

Answer: A TRN, or Tax Registration Number, is a unique identifier issued by the Federal Tax Authority (FTA) in the UAE to businesses and individuals registered under the VAT system. It’s used for tax purposes, ensuring compliance and proper reporting of VAT-related transactions.

2. How long does it take to get a TRN after applying through Adam Global?

Answer: The typical processing time for a TRN application through Adam Global is between 10 to 20 working days. However, this can vary based on the completeness of the provided documentation and the current workload of the FTA.

3. Are there any fees associated with obtaining a TRN through Adam Global?

Answer: Yes, there are service fees charged by Adam Global for assisting with the TRN registration process. The exact fee can vary based on the complexity of the application and any additional services availed. It’s best to consult directly with Adam Global for a detailed fee structure.

4. What happens if my TRN application is rejected?

Answer: If your TRN application is rejected, the FTA will provide reasons for the rejection. Adam Global will assist in addressing these concerns and can help resubmit the application after making the necessary corrections or providing additional documentation.

5. Do I need to renew my TRN periodically?

Answer: No, once you obtain a TRN in the UAE, it does not have an expiration date. However, businesses are required to ensure ongoing compliance with VAT regulations and to update the FTA with any significant changes to their business details